- Occupier demand,

- The industrial sector,

- The retail sector,

- The office sector,

- The leisure and hotel sector,

- The residential sector, and

- Real estate investment

Key insight:

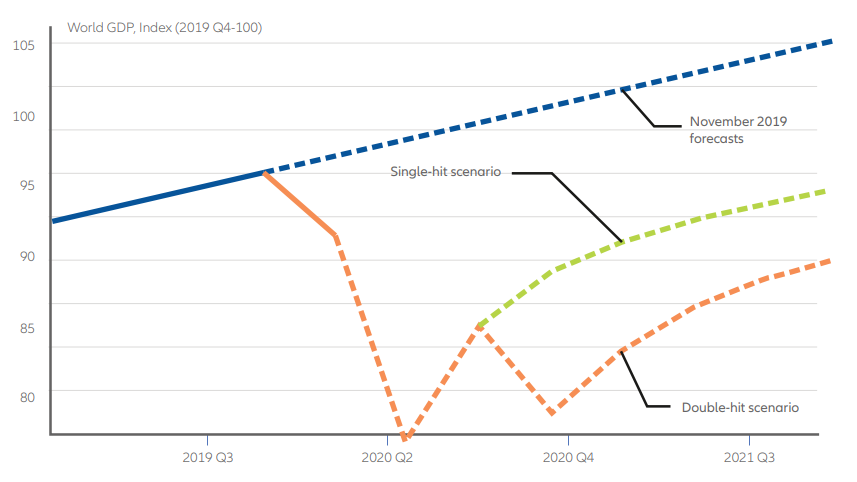

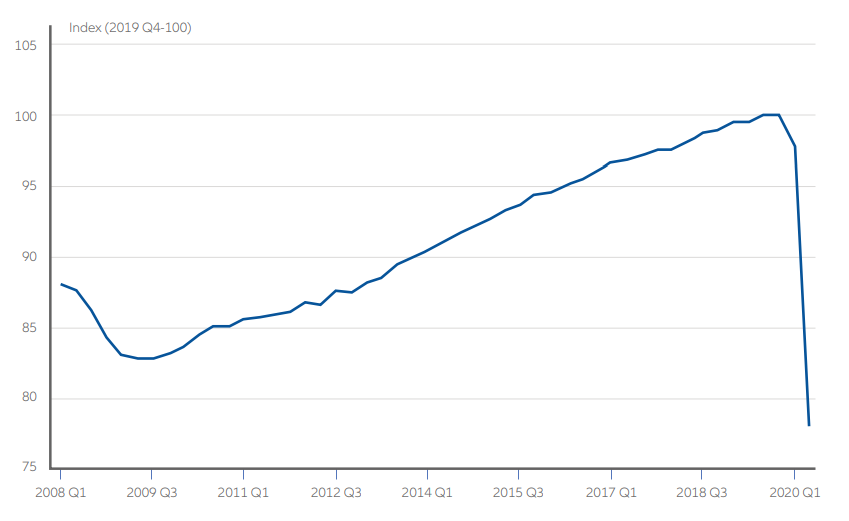

A collapse in out put followed by a slow recovery

In Q2, GDP in the UK fell by 20.4% which is “the largest quarterly contraction in the UK economy since Office for National Statistics quarterly records began in 1955”(ONS, 2020)

. The contraction of the economy is largely the result of reduced consumer spending during national lockdown and subsequent social distancing measures. The Financial Times explains that “Household spending makes up the largest part of the economy” and so “the recovery largely depends on consumers regaining the confidence to increase spending from ultra-low levels.” (FT, 2020).

Real GDP fell by 20.4% in quarter 2 2020, the largest quarterly contraction on record

Households have cut back their spending for a number of lockdown related reasons. There has been a plunge in hours worked and national incomes have been under pressure with average earnings falling by 1% (year on year 3 month average reported by the ONS for July) (ONS, 2020). Unemployment rates have not risen as drastically, with the ONS reporting an unemployment rate of 4.1% between May and July (ONS, 2020). However, this does not take into account those not actively seeking work and also as the furlough scheme ends this figure is likely to rise further. On top of this, confidence levels have plummeted as uncertainty grows around the future of the economy.

As well as a strain on finances, an ONS publication (ONS, 2020) provides insight into how the government lockdown measures have directly affected spending. In the financial year preceding lockdown, on average a household would spend “22% of a usual weekly budget of £831” on “activities that have since been largely prevented by government guidelines (such as travel, holidays and meals out)” which leads the ONS to conclude that “more than one-fifth of usual household spending has largely been prevented during lockdown”.

Real estate market trends

Industrial sector

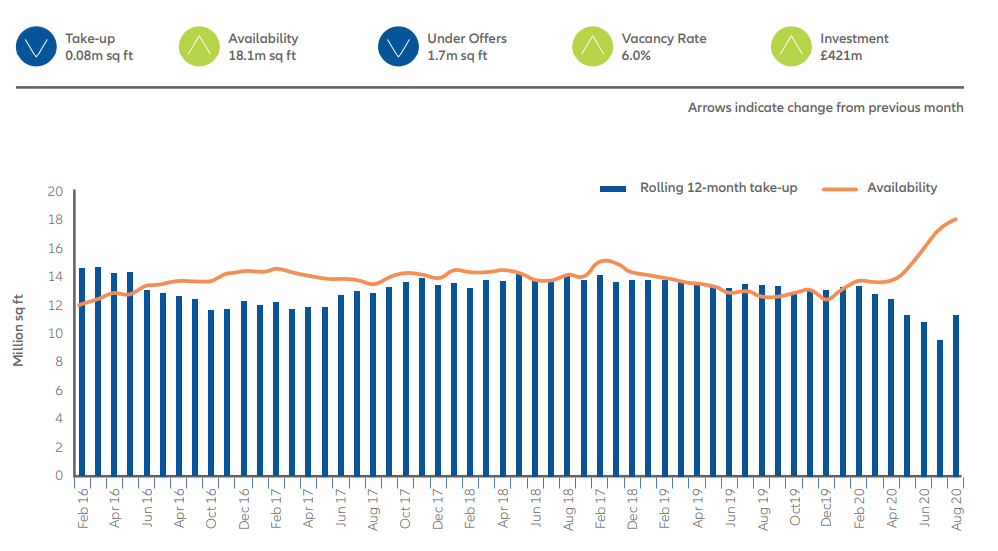

One clear shift in household spending, which has accelerated during lockdown, has been toward online rather than in store consumption. This has had two major impacts, one that is positive for the industrial sector and one that is negative for high-street retail. An increase in purchases from grocery and online retailers has led to increases in warehouse demand. The CBRE Logistics Market Update (CBRE, UK Logistics Market Update September 2020, 2020) reported that there was a “record high quarterly demand in Q2” with a “UK recorded take-up of 19.1m sq ft during H1 2020”. It also reported that “online retailers were directly responsible for 40% of the demand” which led to a record-breaking quarter. In fact, the demand driven by online sales has been so significant that a JLL article (JLL, Why big-box retail stores are turning into warehouses, 2020) describes how “pressure on the logistics sector to keep pace with the boom in online shopping is prompting developers to convert large-format retail sites into warehouses” For example, “Industrial property company Prologis purchased Ravenside Retail Park, 15km from central London, for £51.4 million and has earmarked the site for ecommerce fulfilment.”

Another contributor to increased demand within industrial and logistics is from the R&D space. A Savills publication (Savills, Big Shed Briefing Topic Response issue 2: mid-tech industrial, 2020) on the mid-tech industrial space explains how the rising global interest in vaccine production due to COVID has “stimulated a much larger real estate interest in the R&D and life science sector than any time during the past 20 years”. The report suggests that “mid-tech industrial units could be the solution to this rising demand.” The publication anticipates that “in order to be desirable, the quality of construction of the industrial unit, cladding, glazing and internal finishes must be comparable to contemporary office building”. This is a trend that could further accelerate as a vaccine is produced and “landlord and developers of ‘mid box’ industrial units could start to make minor amends in both marketing strategy and offering to attract the influx of R&D occupiers seeking to locate throughout the UK.”

Overall, the future outlook for the industrial / logistics space looks positive, CBRE (CBRE, Market Update: UK Logistics, 2020) anticipates “rental growth to regain some traction again during Q3, pushed by the strong demand and lack of ready-to-occupy units”. A JLL report (JLL, COVID 19: Global Real Estate Implications, 2020) expects that logistics will continue to experience “increased online penetration rates, expansion of online grocery, omni- channel retailing and the integration of technology into warehousing.”

Retail sector

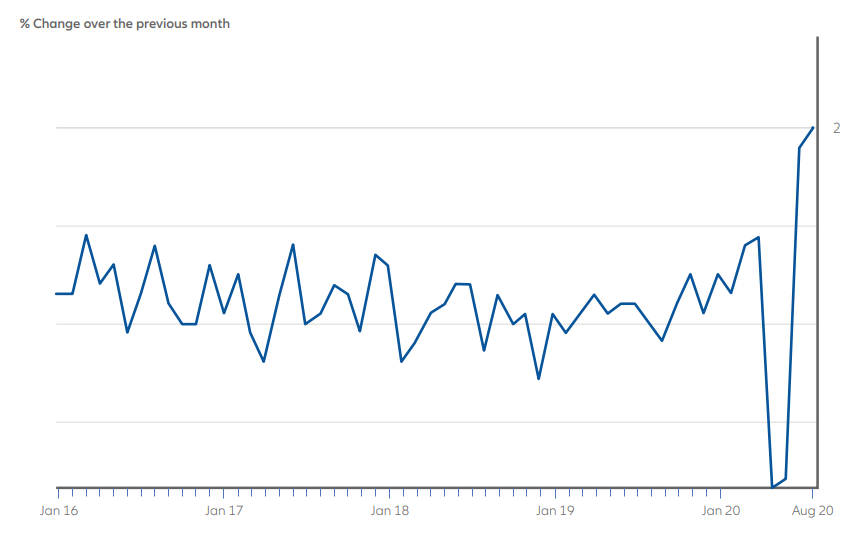

In contrast to this, high street retail has experienced a drop in demand as consumers move to shopping online. Overall retail consumption saw a rebound in sales over summer, with retail sales growing for the 4th consecutive month, the ONS reported figures (ONS, September) show that “retail sales volumes increased by 0.8%” for August compared to July. However, a FT article (FT, UK retail sales rise for fourth consecutive month, 2020) reflects on the ONS data that “high-street stores remained under pressure despite the fourth consecutive monthly sales expansion, as consumers continued to shop online.” Looking more closely at where these sales have been sourced, ONS data reported for August that “non-store retailing volumes were 38.9% above February, while clothing stores were still 15.9% below February’s pre-pandemic levels.”

As well as reduced high-street retail transactions, Savills Property Management (Savills P. , 2020) reported “19% of shopping centre rents being received on the June quarter date, whereas single-let and high street retail received 58%.” The Savills report also identified other trends including “rising rent-free periods as well as landlords using capital contributions to entice potential tenants” These findings highlight the potential risk that COVID presents of tenants defaulting on their rent. In fact, across the whole commercial real estate market, it was found that “only 48% of rent was collected, and only 40% of service charge.”

Office sector

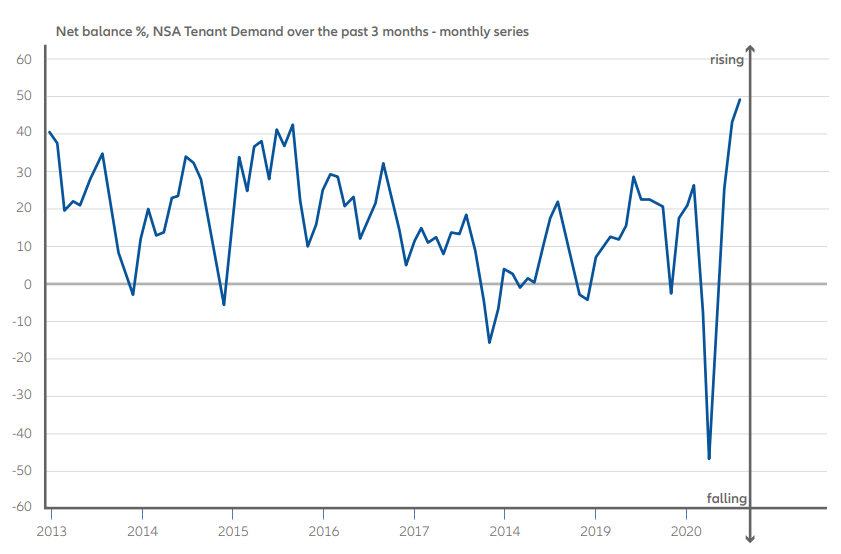

The outlook for the office sector portrayed by the RICS Commercial Property survey is that “93% of respondents anticipate that businesses will look to scale back their office space requirements to some extent in the coming two years on account of the increase in remote working during the pandemic.” Another trend which was suggested in the RICs survey was that there would be a shift in demand for office space from urban centres over to suburban locations over the next two years and “64% of respondents thought this shift would occur”.

These results encompass cultural changes which have been accelerated due to lockdown restrictions, trends were already identified pre lockdown by the Deloitte’s Economic Outlook (Deloitte, 2019) include “changing workforce demands, such as flexible location and workspaces, and technology advancements”. As a result of such a shift, the CBRE EMEA mid year report (CBRE E. , n.d.) sees “occupier demand shifting increasingly towards tech-enabled ‘smart’ space, offering development or refurbishment opportunities.” Despite the contraction in demand for office space, there are many reasons to believe that offices will continue to be an integral part of working life as behavioural changes lead to reinvention in the concept of offices. JLL published a report which argues that “increased working from home doesn’t equate to less demand.” (JLL, The Future of global office demand, 2020). It suggests that employers will increasingly have “focus on well-being and some de-densification, along with improvements to design to encourage the interaction that is difficult to facilitate at home” which is “likely to offset a decline in space as a result of increased homeworking.” Additionally as the Knight Frank COVID publication (Knight Frank, 2020) puts it, “the office will become a personal choice rather than professional obligation” which is likely to set a trend which “heightens the flight to quality office space that has been evident in major global markets for the last few years. The office must be a compelling proposition.”

Leisure and hotel sector

Residential sector

Real estate investment

Summary of key points

UK economic outlook

The UK economy has experienced a significant contraction in GDP in Q2 which is largely due to reductions in household spending. Which in turn can be seen as attributable to national lockdown and government COVID measures.

Real estate trends

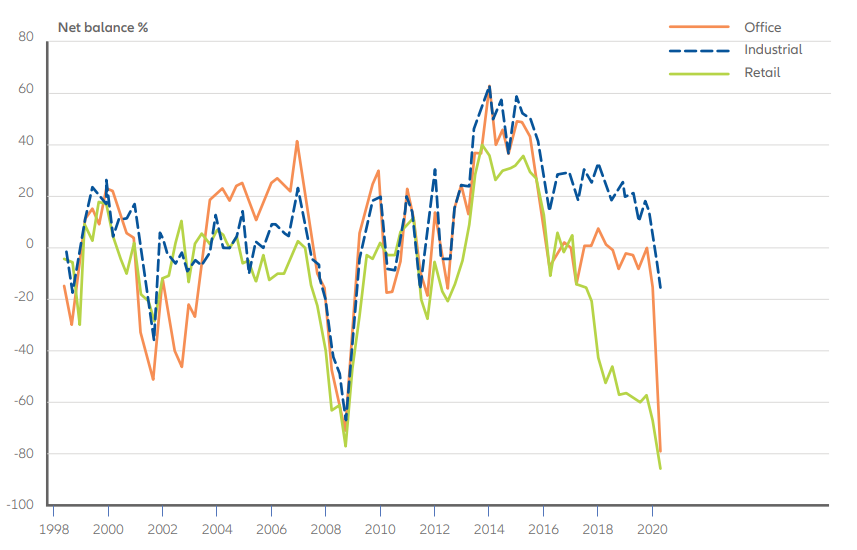

Commercial real estate has experienced a fall in occupier demand with 55% of RICS respondents seeing a decline. Respondents also show rental expectations for the next 12 months of office space and retail to be negative.

Industrial sector

The industrial subsector has experienced a record high quarterly demand in Q2. Contributing to this growth has been the shift in spending habits toward online consumption.

The boom in online shopping is prompting developers to convert large-format retail sites into warehouses.

The industrial sector is predicted to see continued increases in rental growth with technology further evolving warehouse propositions.

Retail sector

Meanwhile, online retail demand has reduced demand for high-street retail.

While overall retail consumption has rebounded over summer, high-street retail continues to struggle.

Savills reported that only “19% of shopping centre rents being received on the June quarter date, whereas single-let and high street retail received 58%.” This reflects the ongoing threat to landlords of tenants defaulting on rent due to COVID impacts.

Consumer habits within the retail space are increasingly considered as structural changes rather than temporary.

CBRE anticipates a trend toward the “repurposing of retail assets, including retail warehouse parks to urban warehousing.”

While JLL looks longer term at how retail may evolve “as the structural change in the retail market accelerates, greater emphasis will be placed on the shift toward a flexible omni-channel retail model and sustainable fulfilment”.

Office sector

There has been a contraction in demand for office space leading to vacancies in the market. 93% of RICS survey respondent’s “anticipate that businesses will look to scale back their office space requirements to some extent in the coming two years on account of the increase in remote working during the pandemic.”

On the other hand, CBRE EMEA mid year report said “occupier demand shifting increasingly towards tech-enabled ‘smart’ space, offering development or refurbishment opportunities.”

Knight Frank publication anticipates a trend toward “quality office space that has been evident in major global markets for the last few years. The office must be a compelling proposition.”

Leisure and hotel sector

The Leisure and Hotel industry have been impacted by the reduction in tourists due to travel restrictions.

Domestic travellers have helped the industry to rebound over summer. However, consumers have sought more remote and less busy locations such as coastline destinations.

Within the Leisure and Hotel industry it is budget hotels which are seen as likely to recover the quickest, with the corporate-reliant markets suffering the most from reduced travel.

Residential sector

On the residential side of the market, the housing market has been booming despite the economy being in recession.

Tim Bannister, Rightmove’s Director of Property Data comments that “some people are now choosing to move out of London altogether, but these latest figures show that there’s still plenty of activity in the outer areas of the capital.”

It is unlikely the housing boom will continue as furlough ends and unemployment figures are likely to rise.

Real estate investment

Some investors have shifted toward higher quality assets.

JLL’s global report anticipates that “There will be increased demand for new workplace design, including more digital, flexible and health-oriented working solutions.”

BofE. (2020, September). The Economy and COVID-19: Looking Bank and Looking Forward. Retrieved from https://www. bankofengland.co.uk/-/media/boe/files/speech/2020/the-economy-and-covid-19-looking-back-and-looking-forward-speech-bymichael-saunders.pdf

CBRE. (2020, August). Retrieved from Investment market supported by key Docklands deal: http://cbre.vo.llnwd.net/grgservices/ secure/CL%20Monthly%20MarketView%20August%2020_Dv3N.pdf?e=1602437643&h=5e5c633c5477940303a17ac5f2731619

CBRE. (2020, September). Indicators of Recovery - The Residential Market. Retrieved from http://cbre.vo.llnwd.net/grgservices/ secure/Residential%20Recovery%20Indicators%20Sept%202020.pdf?e=1602438604&h=2078e6a1d651999c04242897995519f7

CBRE. (2020, September). Market Update: UK Logistics. Retrieved from http://cbre.vo.llnwd.net/grgservices/secure/CBRE%20UK%20 Logistics%20Special%20Market%20Update%20_Covid-19_%20-%20September%202020_R7kd. pdf?e=1602436897&h=a300c1665369b3a28e5342787844fc27

CBRE. (2020, September). UK Logistics Market Update September 2020. Retrieved from https://www.cbre.co.uk/research-andreports/United-Kingdom-Logistics-Market-Update-September-2020

CBRE, E. (n.d.). EMEA real estate market outclook 2020 mid year review. Retrieved from http://cbre.vo.llnwd.net/grgservices/secure/ EMEA%20Mid%20Year%20Outlook_Final.pdf?e=1602429222&h=0aadb0da899f5a7f2b13ed6ba38d5e98

Deloitte. (2019, October). Retrieved from https://www2.deloitte.com/us/en/insights/industry/financial-services/commercial-realestate-outlook.html

FT. (2020, September). Retrieved from https://www.ft.com/content/272354f2-f970-4ae4-a8ae-848c4baf8f4a

FT. (2020, September 06). High house prices paint a partial picture of UK real estate. Retrieved from https://www.ft.com/ content/271ba975-34ce-4220-8cee-4433b15ada31

FT. (2020, September 02). UK house prices surge to record high. Retrieved from https://www.ft.com/ content/53a76828-7763-451a-99d6-e7bdd2bd96d7

FT. (2020, September). UK retail sales rise for fourth consecutive month. Retrieved from https://www.ft.com/ content/8b2acee7-87c1-4320-aab8-eae1170331b7

JLL. (2020, April). COVID 19: Global Real Estate Implications. Retrieved from https://www.jll.co.uk/en/trends-and-insights/research/ covid-19-global-real-estate-implications

JLL. (2020, June 23). The Future of global office demand. Retrieved from https://www.jll.co.uk/en/trends-and-insights/research/ future-of-office-demand

JLL. (2020, October 07). Why big-box retail stores are turning into warehouses. Retrieved from https://www.jll.co.uk/en/trends-andinsights/investor/why-bigbox-retail-stores-are-turning-into-warehouses

Knight Frank. (2020, September). COVID 19 - what we know, what we expect, what we question. Retrieved from https://content. knightfrank.com/research/1957/documents/en/covid-19-commercial-research-september-2020-7430.pdf

OECD Economic Outlook. (2020, June). Retrieved from http://www.oecd.org/economic-outlook/june-2020/

ONS. (2020, August). Retrieved from https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/ gdpfirstquarterlyestimateuk/apriltojune2020

ONS. (2020, September). Retrieved from https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours

ONS. (2020, September 15). Retrieved from https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment

ONS. (2020, June 11). Retrieved from https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/ expenditure/articles/morethanonefifthofusualhouseholdspendinghasbeenlargelypreventedduringlockdown/2020-06-11

ONS. (September, 2020). Retrieved from https://www.ons.gov.uk/businessindustryandtrade/retailindustry/bulletins/retailsales/august2020

RICS. (n.d.). Q2 2020: UK Commercial Property Market Survey, Retail and office sectors hit hardest by pandemic. Retrieved from https://www.rics.org/globalassets/rics-website/media/market-surveys/gcpm/rics-uk-commercial-property-market-survey---q2-2020. pdf

RICS Residential. (2020, August). Retrieved from https://www.rics.org/globalassets/rics-website/media/knowledge/research/marketsurveys/uk-residential-market-survey-august-2020.pdf

Rightmove. (2020, September). House Price Index. Retrieved from https://www.rightmove.co.uk/news/house-price-index/

Savills. (2020, October 06). Big Shed Briefing Topic Response issue 2: mid-tech industrial. Retrieved from https://www.savills.co.uk/ research_articles/229130/306098-0

Savills. (2020, October 01). Spotlight: UK Hotel Investment Report. Retrieved from https://www.savills.com/ research_articles/255800/305787-0

Savills. (2020, October 01). Where’s leading the recovery in the hotel market? Retrieved from https://www.savills.com/ research_articles/255800/305791-0

Savills, P. (2020, August 06). Spotlight: Shopping Centre and Highstreet - Q2 2020. Retrieved from https://www.savills.com/research_ articles/255800/303206-0/spotlight--shopping-centre-and-high-street---q2-2020/