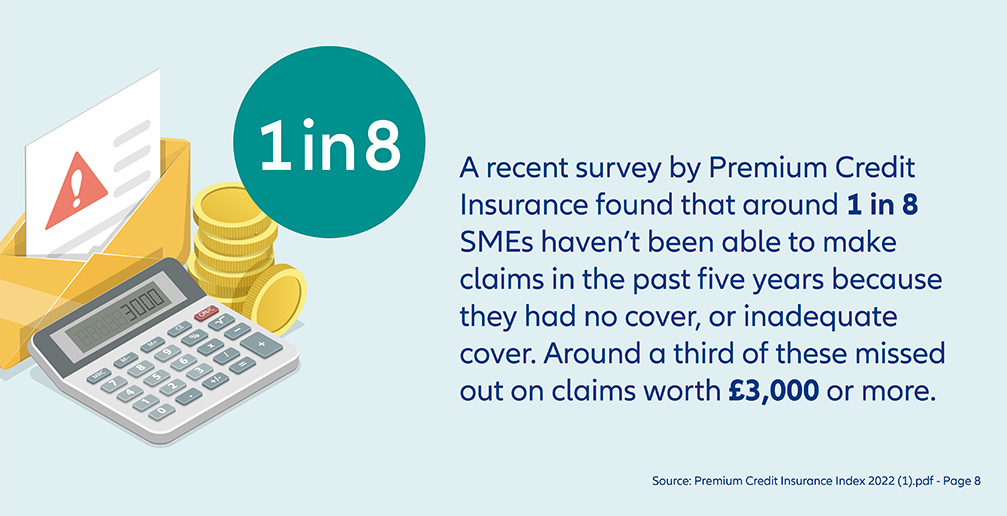

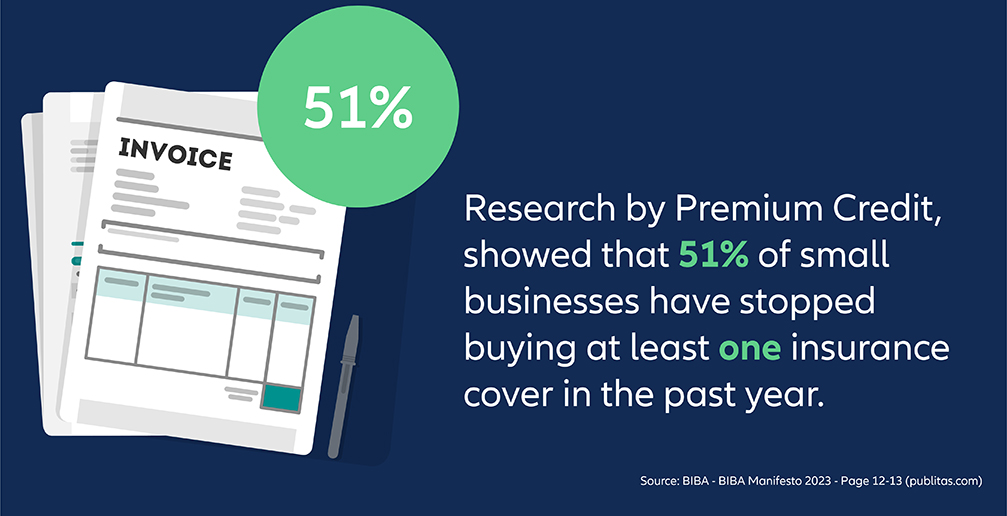

The cost of living is at an all-time high and as a result we’re seeing evidence of businesses either reducing their cover, or cutting it completely. BIBA’s 2023 Manifesto, states that in the past year, 51% of businesses have stopped buying at least one insurance cover and research from our recent survey1 has found that one in five (19%) of SMEs have reduced their insurance cover over the past 12 months.

All businesses are open to risk if they don’t have the correct level of insurance for their needs, and some, more than others, may be at risk of financial hardship as a result of being either underinsured or uninsured. Here we talk about the risks of both.

Uninsured

Why might businesses be uninsured?

Due to the UK’s challenging economic climate, it can be tempting for businesses to try and reduce their overheads by cutting back on insurance. For example, businesses might decide to avoid paying insurance premiums by cancelling, or not taking out, cover for some areas. There is no law that requires a business to have public liability insurance for example; however without it, a business is at risk of not being able to pay compensation should a member of the public claim that they’ve been injured, or their property damaged, because of the business’s activities.

Some businesses may be uninsured because they don’t realise that they need a particular type of insurance or are unaware of the risks they are exposed to by not having the correct insurance in place.

Underinsurance

With the rising cost of living and high inflation, a lower cost policy might seem attractive as the business owner pays less each month in insurance premiums. But, if the policy leaves them exposed to risk by being underinsured, then the loss arising from a claim may be far more than any savings they may have made on premiums.

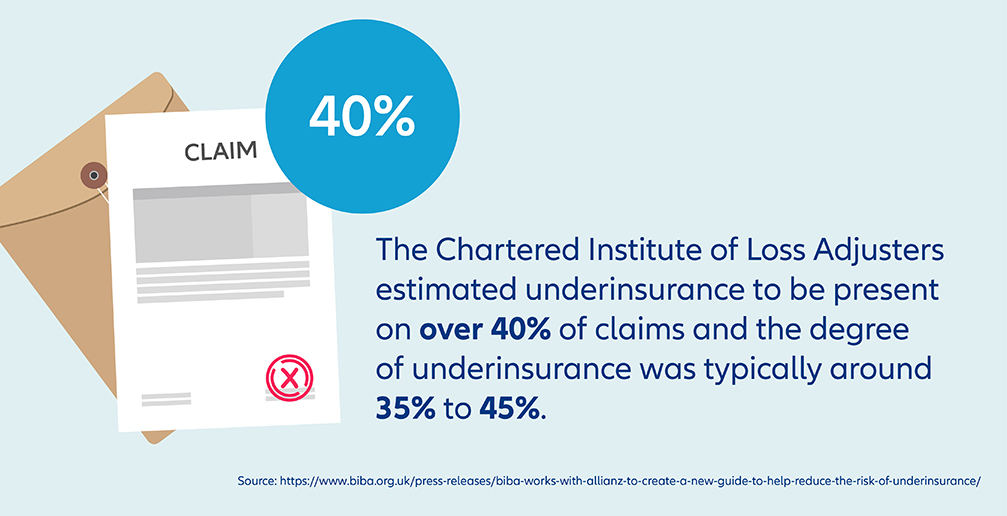

Underinsurance occurs when a business doesn’t have adequate cover in place. The business may have an appropriate policy, but the limits don’t provide enough cover for the event that it wants to be insured against, consequently, the business is underinsured for its needs. This can have severe consequences in the event of a loss.

Often businesses end up being underinsured without even realising. For example, a construction company might have a business interruption insurance policy in place, but events such as Brexit and the conflict in Ukraine could mean that it takes longer for the business to resume normal operations – in which case the policy that the business has may no longer provide enough cover.

Inflation, recession and labour shortages, as well as supply chain delays, all have an impact on a business’s insurance cover because the cost to replace tools, machinery and other physical assets might increase, or take longer to manufacture due to a shortage of parts. This may mean that the policy that covers them would need updating to take these into account.

Business needs can also change. For example, revenue might increase; the terms of reference might change; or the business could switch from being privately to publicly owned. If changes like these occur, the business’s financial lines insurance, which covers financial loss and the costs involved with this, will need to be reviewed and updated.

Where a business is underinsured some insurers might apply the average clause. This means that if the insurer finds the business hasn’t taken out adequate insurance, it can reduce the settlement by the same percentage.

For example -the insured has an annual turnover of £1 million, with £600,000 gross profit. They took out a business interruption policy, with a sum insured in line with the £600,000 gross profit. The policy, however, is written on a 24 month indemnity period – meaning that the sum insured applies across two years. The means that they are only 50% covered and if the business suffered a loss and made a claim for £200,000 to cover the four months it was unable to operate the insured would only receive £100,000 as the average clause would be applied.

If an insurer believes a policyholder’s sums insured has been deliberately understated, it’s within its rights to void the policy altogether. Under the Insurance Act 2015, policyholders have a duty of fair presentation of risk, which requires them to disclose every material circumstance they know or should know.

The expertise of the broker is paramount - brokers work closely with their customers to ensure business have the right level and type of cover.

Why might businesses be uninsured?

All businesses are vulnerable if they are either uninsured or underinsured, but some businesses are more affected than others. Property, construction and SMEs are more at risk of serious financial hardship as a result of being uninsured or underinsured due to the size and nature of these businesses.

External factors like economic turmoil, climate change, global pandemics and changes in government policy all have an impact on the costs and availability of materials, delivery timescales and labour. If businesses aren’t insured against disruption to supply chains or financial losses as a result of business disruption, they could find themselves liable for huge financial sums which they’ll have to cover.

Without the correct level of business insurance, a business will have to pay for any compensation claims itself to cover the cost of replacement, such as tools and equipment, stock, repair of premises etc. These unforeseen costs could be catastrophic, especially for smaller business.

It’s also the case that some trading authorities and other organisations might require a company to have a certain level of insurance for a particular area in order to work with them, and so not having insurance in place could mean that the company fails to secure new business opportunities.

Regardless of the type of business, all businesses should review their insurance annually, or at any time there is a significant change to their business, including their financial lines cover, to ensure they’re not at risk.

Brokers play a key role in not only helping their customers understand what their sums insured and indemnity periods should be, but also in explaining the wider benefits insurance can offer, beyond just financial protection. This might include expert advice or securing alternative premises, depending on the policy.

How can you help your customers to avoid being without adequate insurance cover?

- Help customers to correctly calculate the amount of insurance cover they need, taking into account any seasonal changes over the course of the year - e.g. any increases of stock

- Help your customers understand the different terms associated with insurance e.g. 'sum insured' and 'limit of indemnity' etc.

- Help customers to select an appropriate indemnity period for business interruption cover

- Encourage regular variations and assist customers in reviewing their policies annually

- Help ensure policy limits are appropriate

- Appreciate that periods of high inflation may increase the risk of underinsurance.