09 September 2025

Understanding underinsurance and the risks of being underinsured

“In the current market, businesses face a landscape shaped by trade tensions, environmental issues and unpredictable politics. Economic growth is expected to slow but despite inflation rates easing, supply chain disruptions, labour shortages, and fluctuating costs persist. These challenges make it crucial for companies to reassess their insurance coverage. Indemnity periods under 12 months may not provide adequate protection, especially against the backdrop of such elevated external risk issues. Businesses should consider extending these periods to better manage potential disruptions and safeguard their future.”

Nick Hobbs, Chief Distribution Officer

What is underinsurance?

Underinsurance occurs when a business's insurance coverage is not enough to fully cover potential losses. This means that in the event of a claim, the insurance policy may not cover the entire cost of damages or disruptions, leaving the business financially vulnerable. Underinsurance can result from incorrect valuations, unrealistic indemnity periods, changes in business operations that are not reflected in the insurance policy or higher than expected liability claims.

All businesses are open to risk if they don’t have the correct level of insurance, and some, more than others, may be at risk of financial hardship as a result of being either underinsured or uninsured.

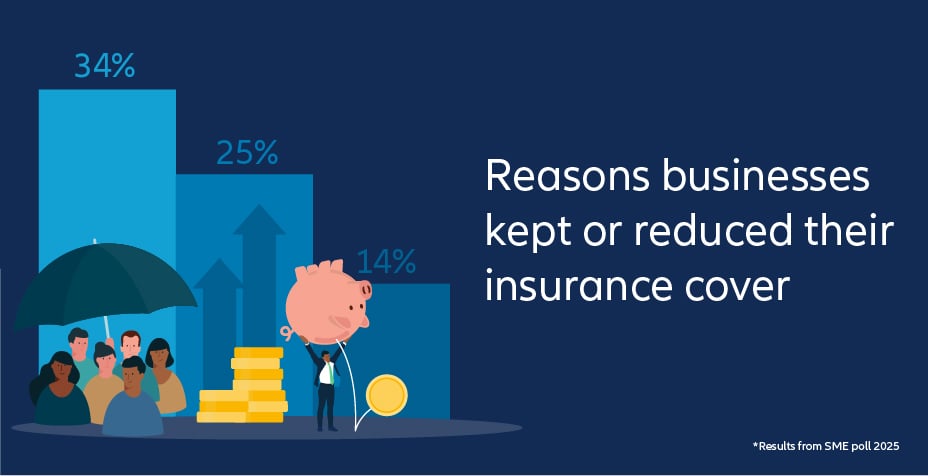

Although the UK is not currently in recession, continued economic uncertainty and low productivity means growth is expected to slow and we’re seeing evidence of businesses dropping aspects of cover.

Some of the ways a business might be underinsured

Incorrect sums insured

When something goes wrong, businesses are covered for their ‘sums insured’, which is how much it would cost to reinstate the business in the event of a loss, up to a certain amount. If this isn’t calculated correctly, businesses could find themselves underinsured. An up-to-date inventory of all a business’s contents can help set the right sum insured. This needs to take into consideration everything in the premises. It should also reflect peak stock levels, rather than the average.

Unrealistic indemnity periods

Many businesses underestimate how long it will take to fully recover their trading level after a loss, with many opting for a 12-month indemnity period rather than a more generous – and more realistic – 24-month one. Supply chain issues including building material cost increases and supply demands, global tensions or the general economic environment* can all delay this recovery. This can be the case particularly where a business is in an historic or unusual building that may take longer to rebuild or it has specialist equipment that can take time to replace. Read more on Setting Indemnity Periods.

*Allianz Economic Outlook - Economic outlook & inflation (allianz.co.uk)

A change in business

Business needs may have changed. For example, revenue might increase; the terms of reference might change; or the business could switch from being privately to publicly owned. If changes like these occur, the business’s financial lines insurance, which covers financial loss and the costs involved with this, will need to be reviewed and updated. Businesses need to check their cover remains in line with their activities.

Incorrect valuation

It’s important the sum insured for buildings represents the full rebuilding cost of the property, and factors changes to material and labour costs. Customers shouldn’t use market value or valuations for mortgage purpose when setting their insurance Declared Value. Read more about finding the right balance Underinsurance in property and Avoiding Underinsurance in Construction | Allianz Insurance.

Increased operational costs (59%), Changes in consumer demand (45%) and Regulatory changes (38%) are the top factors impacting businesses in 2025.

The risks of being underinsured

Although not all insurance is a legal requirement, businesses need to ensure that they’re adequately covered against many of the risks they could be exposed too, so they aren’t left in a vulnerable position.

All organisations are vulnerable if they are either uninsured or underinsured, but some businesses are more affected than others. Property, construction and SMEs are more at risk of serious financial hardship due to their size and nature. Not being insured against disruptions caused by external factors such as supply chain issues, labour shortages or economic turmoil, could result in being liable for huge financial sums.

Without the correct level of business insurance, a business will have to pay for any compensation claims itself to cover the cost of replacement, such as tools and equipment, stock, repair of premises etc.

Lacking insurance can also limit growth opportunities, as many partners and regulators require coverage for contracts. Some trading authorities and other organisations might also require a company to have a certain level of insurance for a particular area in order to work with them, so not having certain insurance in place could hinder expansion.

Regardless of the type of business, all businesses should review their insurance annually, or at any time there is a significant change to their business, including their financial lines cover, to ensure they’re not at risk.

Supporting customers and brokers

Brokers play a key role in not only helping their customers understand what their sums insured and indemnity periods should be, but also in explaining the wider benefits insurance can offer, beyond just financial protection. This might include expert advice or securing alternative premises, depending on the policy.

We have put together a number of resources so that you can help your customers protect their business from the risks of underinsurance.

- How to combat underinsurance?

- Guidance notes for sums insured

- Tackling the protection gap and rising cost of insurance - BIBA Manifesto

- Underinsurance hub