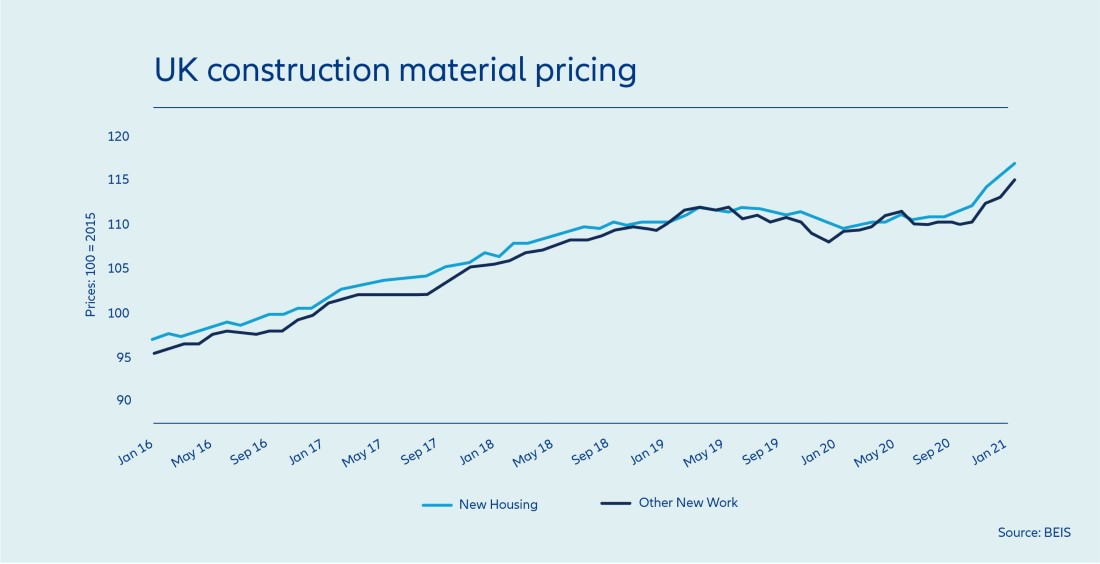

Inflation has risen to its highest level in almost 30 years, due to a number of macro-environmental factors including supply chain disruption, labour and skills shortages and a global recession ensuing from the Covid-19 pandemic. Inflationary pressures on materials and labour have continued to increase costs throughout the post pandemic period, which causes significant industry issues and has an impact on claims inflation. Price increases and inflation are inextricably linked to indexation or ‘index linking’ which is used by the insurance industry to help customers avoid the risk of underinsurance.

The economy is now reopening with consumers spending the money they couldn’t during the lockdown restrictions, resulting in demand outstripping supply across many areas. The rising cost of materials and stock coupled with global supply chain challenges has further compounded the issue.

Index linking is applied by insurers to ensure that an asset’s insured value is adjusted in line with changes in inflation, deflation and the cost of living. Index linking is undertaken to protect against the risk of underinsurance, where a policyholder may find they are responsible for a percentage of the total loss due to their asset not being insured for its full value. By applying index linking, the sum insured is automatically updated (usually increased) in line with economic changes when the policy renews. However, Allianz reviews showed that almost 50% of policies had a buildings sum insured that was less than 80% of the rebuilding estimate.