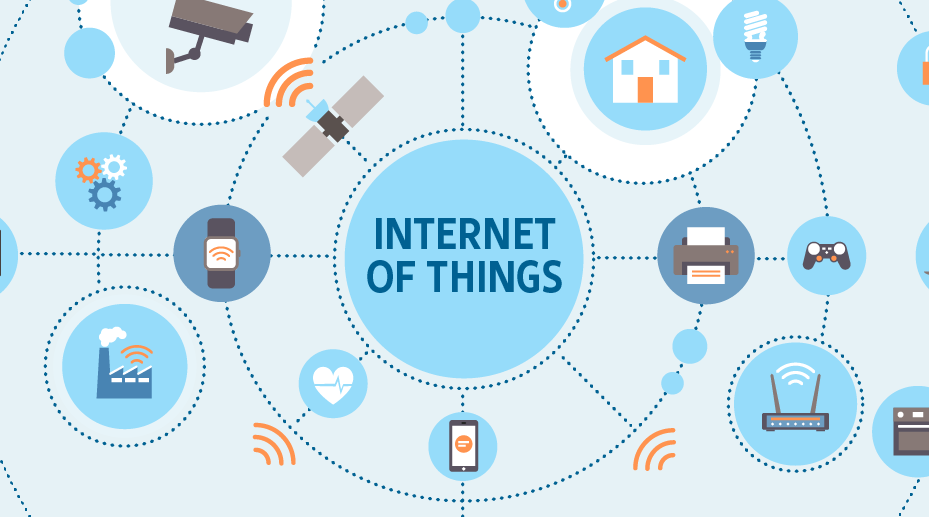

The Internet of Things (or better known as IoT) refers to devices connected to the internet or other networks. These devices can collect and communicate huge volumes of data which can be used for real-time analysis and automatic reactions.

Think beyond your laptop and smartphone, and think about the smart thermostat or speaker in your home, the lift in your office, or the intelligent camera at the airport. As IoT develops more and more devices will join the list.