FOR INTERMEDIARIES ONLY

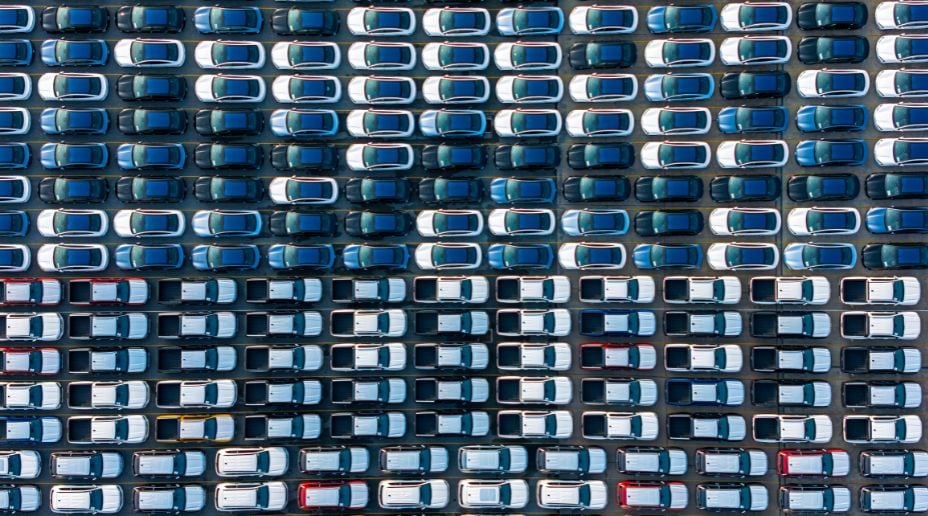

Motor Fleet

Cover for fleets of all sizes, traded via our branch network

Cover for your customers' needs

Comprehensive cover

For business vehicles registered in the UK, including new for old, misfuelling, replacement locks, personal accident, legal protection and medical expenses.

Electric vehicle cover

Road risks as well as third party liability during charging and damage for cables, connectors, electric wallboxes and posts.

Psychological support

Available as optional cover - up to eight sessions of treatment following an accident for the driver and any passengers.

Lifetime guarantee

For repairs within our nationwide network of approved repairers, as well as for windscreen repairs and replacement.

£150 excess reduction *

When an insured vehicle is repaired by our approved repairers. Where possible green parts will be used.

Driver training

Electric vehicle driver training and a range of other fleet management resources accessible at discounted rates from our trusted partners.

Our appetite for Motor Fleet

We’re able to accommodate a broad array of risks and are happy to consider those that sit outside of the following preferred parameters:

Established businesses with a minimum of three years’ confirmed claims experience

Commercial vehicles used for the transport of own goods

Private car schedules (not dominated by high performance vehicles)

Fleets that do not change insurer on an annual basis.

You might also be interested in

Why choose Allianz?

24/7 digital claims updates

Digital claims reporting and tracking via Allianz Claims Hub. As well as quick claims updates through Live Chat.

Fleet analysis

Looking at accident types and occurrence rates we can help identify where a fleet is at risk and make suggestions for remedial action.

Discounted rates

For telematics and tracking technology, fuel saving tools, driver training and breakdown recovery from our service partners.

Electric vehicle guidance

Expertise to support our customers through their transition to electric vehicles.

We're here to help

Have a question? Contact your nearest branch.

-

South East

-

Northern England

-

Midlands

-

South West

-

Wales

-

Scotland

-

Northern Ireland

*Applicable for all Motor Fleet policies incepting or renewing on or after 1 March 2023.

Follow us

This promotional material is intended for insurance broker use only and no-one else should rely upon it.

It must not be made available to anyone other than the intended recipient, either in its original form or any reproduction.

It must not be made available to anyone other than the intended recipient, either in its original form or any reproduction.