We’re committed to being a socially responsible business and a trusted partner for our employees, partners and customers.

Our customers

Our employees

Our products

Our charity work

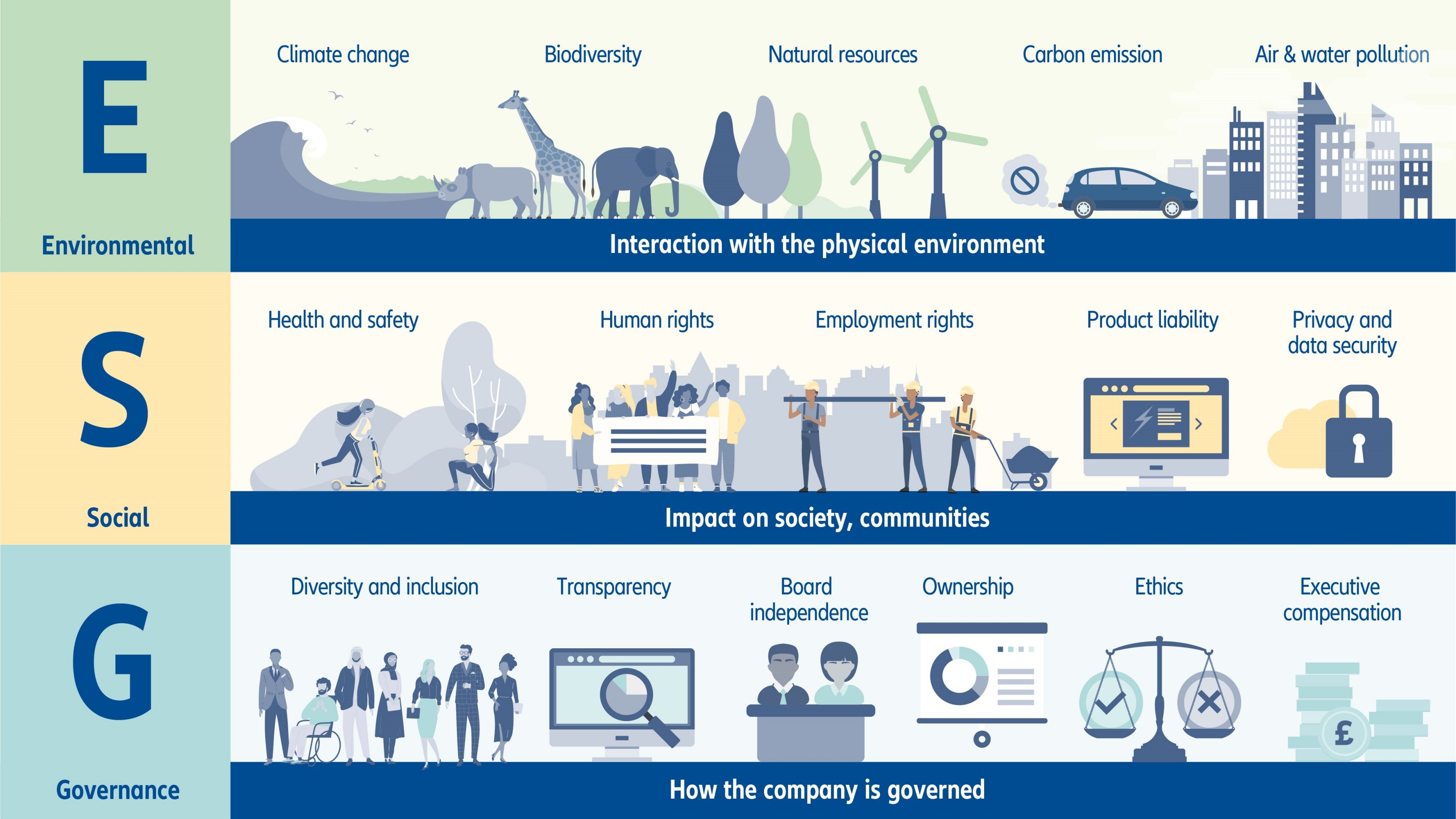

Environmental, Social and Governance (ESG)

Our industry-leading approach integrates ESG concerns by applying Allianz Group-wide corporate rules and ESG instruments across all our underwriting, investment, and asset management activities.

Examples of ESG risks include human rights violations, illegal logging activities, or severe corruption allegations.

However, ESG factors can also present opportunities to induce positive change, such as increased requirements for renewable energy investments or offering solutions for emerging markets. We aim to lead our industry in integrating ESG factors into our insurance and investment decisions.

Becoming more resilient

We believe that the world would be a better place if people were more resilient.

Our business will be stronger with resilient employees. Society is stronger when people are more resilient to change and adversity. Our communities and businesses will be more sustainable if they are resilient to external challenges and our world can become more resilient to challenges like climate change and disasters.

We know that insurance helps build resilience by enabling people and businesses to carry on when the worst happens, but also by helping them to manage potential risks in the first place.

You never know what is around the next corner, but we believe that resilient people and businesses can come back from life’s setbacks stronger than ever.

Our corporate responsibility activity is based around making our customers, employees and society more resilient.

We stand firmly with everyone whose lives have been affected by the

invasion of Ukraine.

Allianz Group is no longer underwriting new business or making investments in Russia and we’re making €10 million available to support humanitarian efforts for Ukraine, along with up to €2.5 million to match employee donations.

Through LV=, our home insurance customers will be able to offer accommodation to refugees without needing to update their policies.

We’re also supporting commercial motor* customers wishing to use their vehicles to provide humanitarian aid. Therefore, in line with the update from the Association of British Insurers (ABI), we’ll grant comprehensive coverage at no additional charge for any cross-border journeys taken for humanitarian reasons within the ‘Free Circulation without Green Card’ zone.

You can read more information from the Association of British Insurers about the industry’s response as a whole. For anything else, please speak to your broker.

*cars, vans & trucks insured under our Motor Fleet, Small Fleet and Mini-Fleet policies